DUN & BRADSTREET

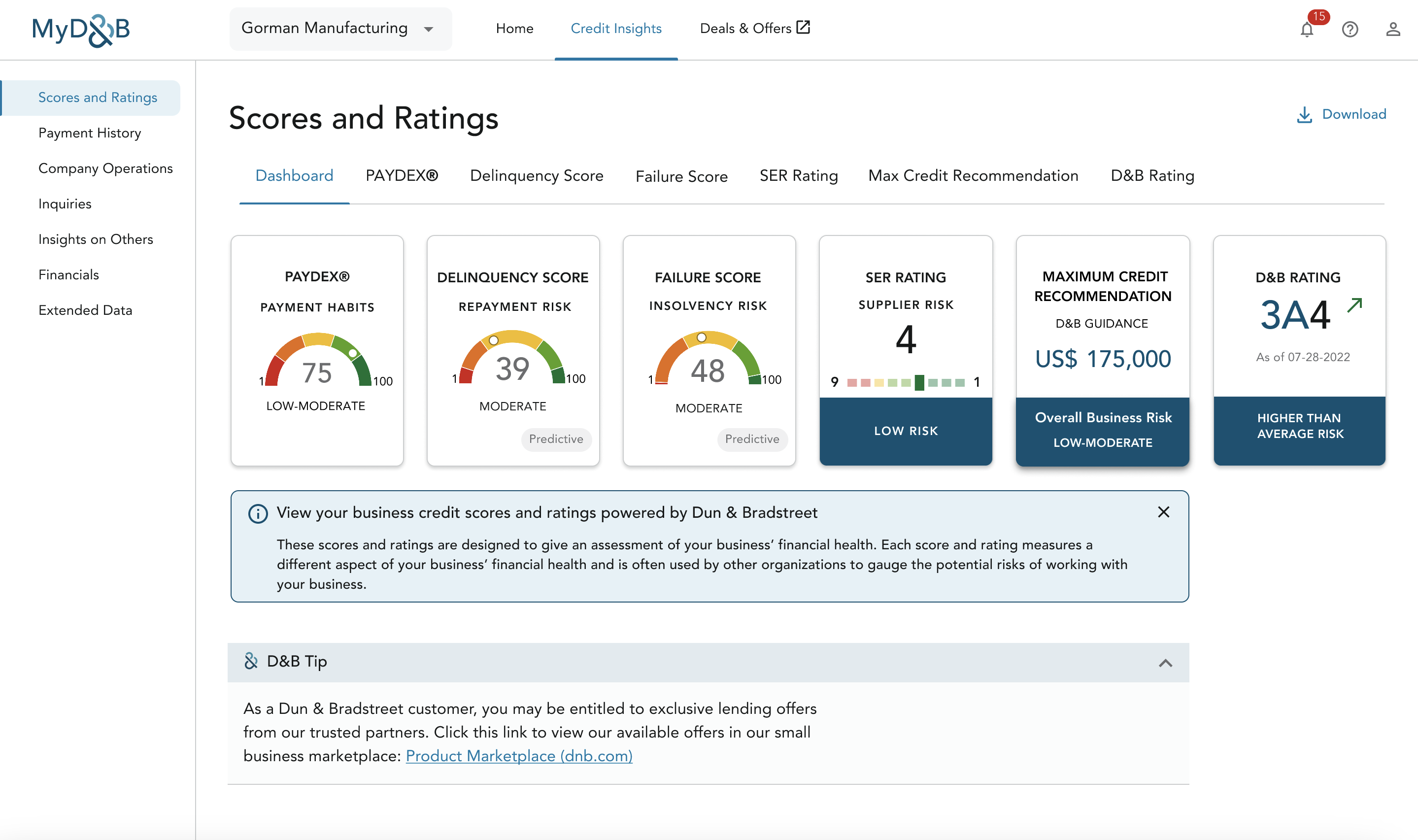

Product: D&B Credit Insights

My Role: Senior UX Designer on a product design triad

Initial Product Metrics – How are we Doing?

With the first release of Credit Insights in October 2023 I initiated a customer satisfaction survey using Net Promoter Score. The legacy product, Credit Builder, was used as a proxy since customers were still using this product.

The results:

- NPS for Credit Insights was 42% higher in Q1 2024 vs. Credit Builder.

- NPS has consitently measured in the 75-80 range.

- Detractors most often mention inaccurate company information and scores not updating as soon as they would like.

I established a UX Tracking survey in January 2024 to measure usability and ease of use.

The results:

- It has consistently averaged 8. 5 – 9 points, out of 10, each month.

- Negative sentiment is often due to customers wanting to view their scores in the Free tier and having trouble updating their company information which takes place in a different D&B product.

I like using surveys because they provide both qualitative and quantitative feedback, through measurable data combined with voice of the customer feedback.

Where we missed

At the end of Q4 2023 paid subscriptions, while continuing to grow, did not meet business OKR’s. This was mainly due to product release delays and the limited number of features available in the first release. At the beginning of Q2 2024 a new higher tier, Credit Insights Plus, was released. It included new features and paid subscriptions doubled in one month.

The good news is that by the end of Q4 2024, Credit Insights was meeting company OKR’s for number of sales and revenue, with an increasing number of people subscribing to a paid tier.

Continuing to measure impact

In Q4 2024, I conceived and spearheaded the effort to establish an attrition survey to understand why people cancel their product subscription. The user will receive the survey upon cancellation. This is a first for a D&B product. The survey is not live yet due to many backend processes needing to be finalized but, the feedback we receive will help us understand why people cancel and will help us to improve Credit Insights.

In 2025 I plan to increase the number of metrics I monitor including engagement, monthly active users, and number of visits.

My Impressions of this project

One of the best things about working on Credit Insights is the amount of creative freedom I am given. I don’t only create the designs, I also write landing page copy, CTA’s, and page copy.

There were some things that could have gone better. I would have like to have done product validation research much earlier in the development cycle. The cause was due to a very tight initial release date.

Fortunately product validation feedback was very positive but, it will take until end Q1 2025 to get the feedback based improvements developed. Going forward, discovery research and feature validation have been made a part of the product development cycle and there is a long product roadmap of additional enhancements to come.