DUN & BRADSTREET

Product: D&B Credit Insights

My Role: Senior UX Designer on a product design triad

A New Direction for Small Business Credit

The Design for Credit Insights

My design process consists of 6 steps:

1. Understand the problem space

This involved meeting with my product manager to learn about the legacy Credit Builder product and discuss the requirements for Credit Insights. Prior research revealed the pain points and needs that users had. I learned what D&B’s vision was for Credit Insights and we discussed what features made sense to carry over into Credit Insights. While the existing scores and ratings and other company data would be the same, how could I make the experience more valuable for customers so they would see the benefits of having a paid subscription?

2. Competitive and Heuristic Analysis

I analyzed competitor websites in the credit industry as well as “consumer grade” SaaS products. Because the vast majority of Credit Builder subscribers were on the free tier, one of the main problems to solve for was how might we get more people to pay?

Analyzing the Credit Builder product showed me that while there was a lot of credit data provided, it wasn’t well organized, it was difficult to understand what the scores meant, there was little purpose to the product apart from viewing credit scores and other business data, and there was no help for how to improve the scores if a customer had low scores.

3. UX Strategy

With the knowledge I had obtained, I collaborated with my product manager on the implementation of the new vision for Credit Insights. Important was to increase engagement and visits apart from users checking to see what their scores were and then canceling their subscription. I looked for ways to employ more data visualizations, imagery, and include content that was more usable and easy to understand. I created a landing page design to introduce Dun & Bradstreet’s CEO and North American product leaders to the new vision for Credit Insights. They were thrilled and approved of the new consumer grade experience.

4. Design

I created the designs for Credit Insights in tandem with my Product Manager and the development team. I was fortunate in that my product manager gave me a lot of creative freedom in creating the designs.

The finished product would represent a new direction for a Dun & Bradstreet product. It would also be the first product to use D&B’s new design system.

My goals for the designs were:

- The UI would have the clean, modern look of popular SaaS apps.

- The data would be easy to understand.

- New copy would help SMB’s to improve and grow their credit.

- It would be a financial product but, have a more “friendly” feel to it.

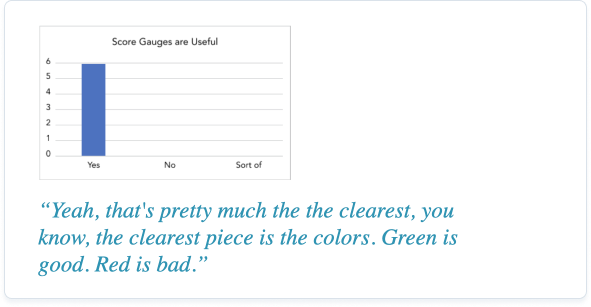

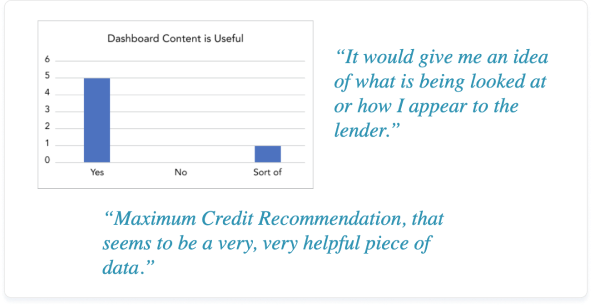

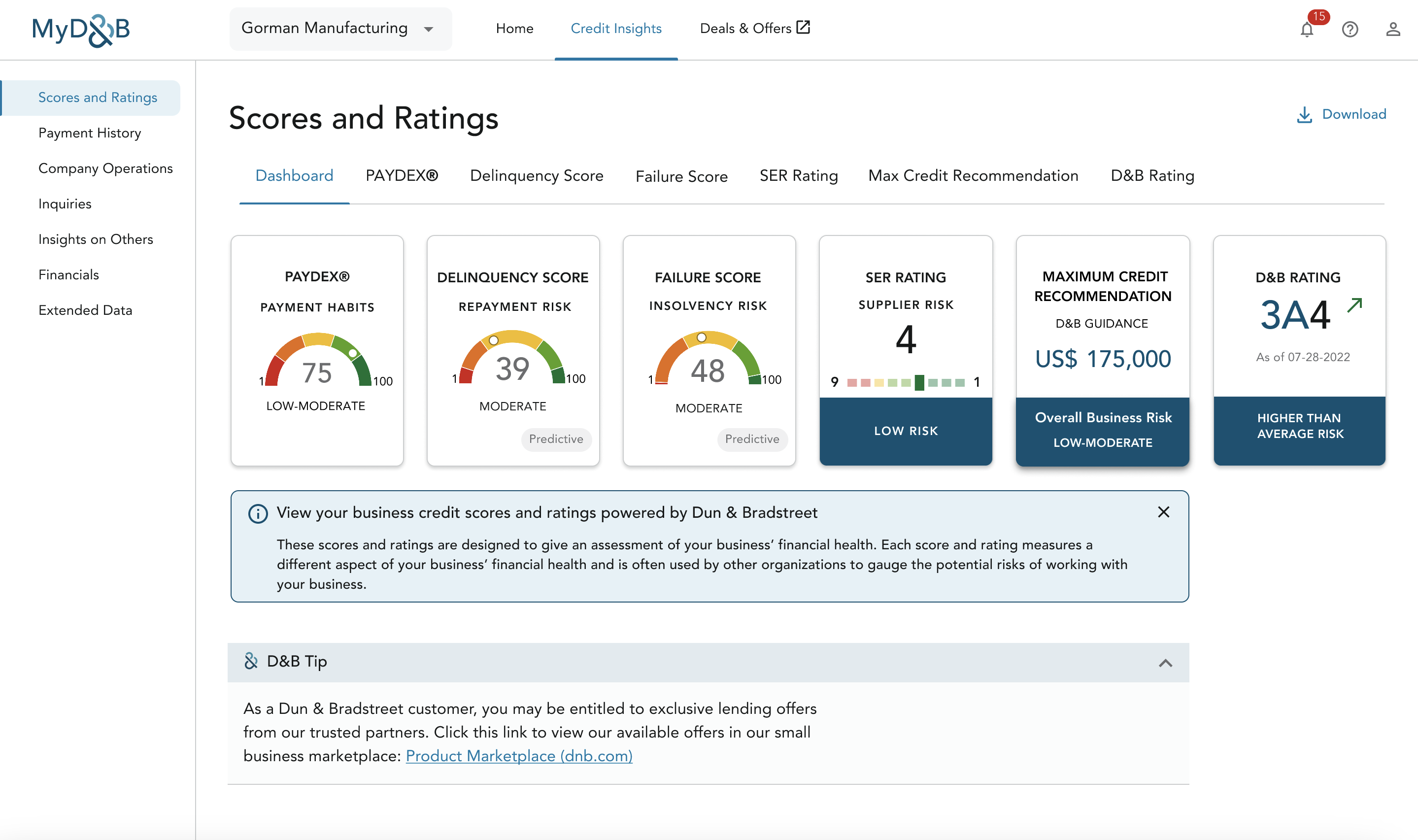

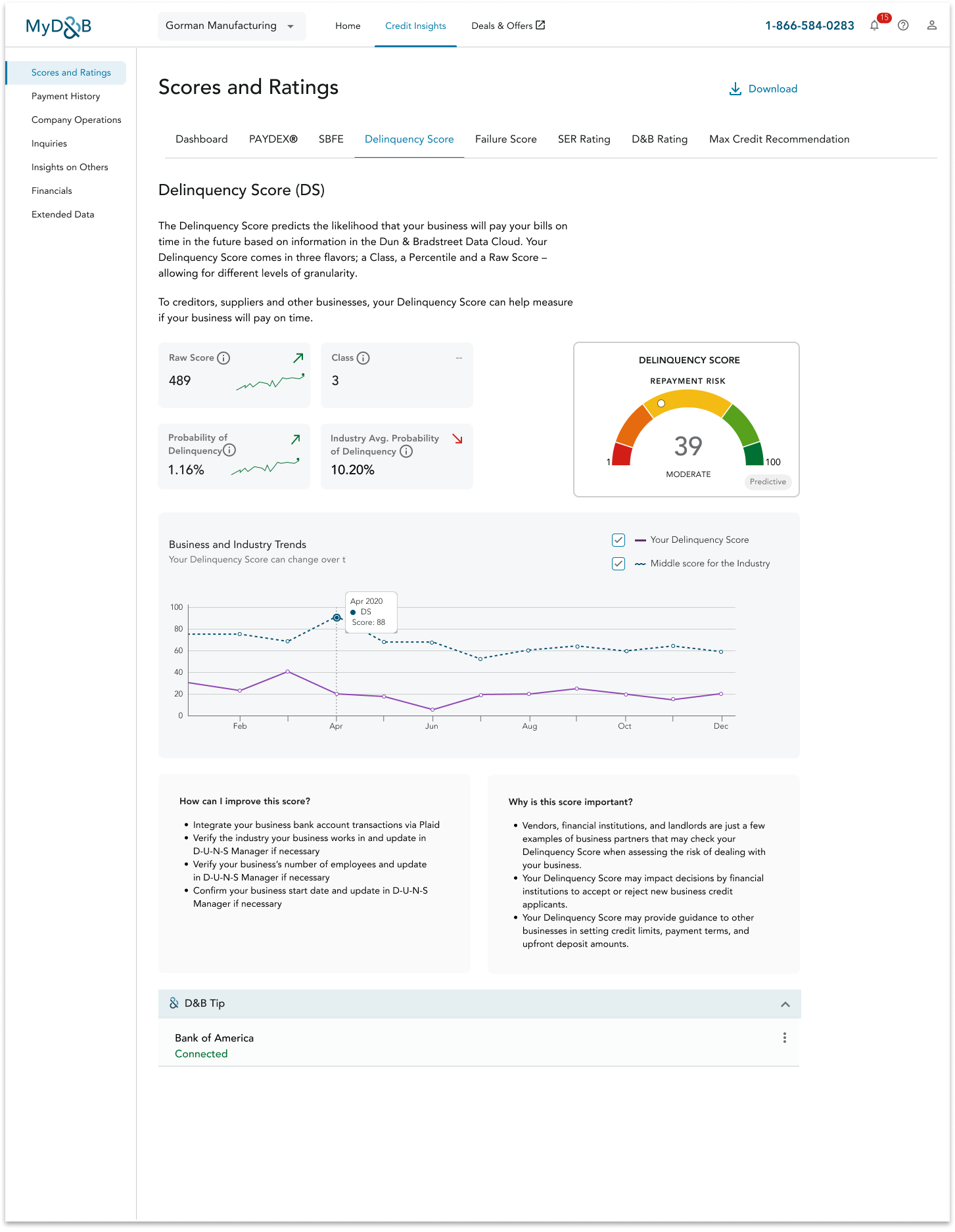

The Scores and Ratings dashboard of Credit Insights acted as the anchor for the rest of the product. I designed a card for each score and rating that showed the score as well as a gauge to indicate risk level. This gave users a quick, high level view of a their company’s credit health.

The gauge provided context because the risk bands differed among the scores. It was a simple way for a user to know whether a score was “good or bad.” I got the idea for the gauge because I designed something similar for Verizon Wireless.

Clicking on a card or tab would direct the user to a page that contained detailed information on that score including why it was important, industry comparison charts, score trend, and tips for how to improve the score.

The other Credit Insights product features designed help users by:

- Providing them a complete picture of their credit strength,

- Enabling them to compare their company to other companies in their industry

- Seeing how other companies may view their business information.

The breadth of features that would be available in Credit Insights would make it different than any other business credit product. I had many ideas and designs but, there was one problem. Credit Builder subscribers were going to be migrated to Credit Insights and legal determined that there needed to be feature parity between Credit Builder and Credit Insights. This meant having to pare down my designs into two and sometimes three different versions. While I was disappointed that I couldn’t give users what I thought would be a greatly improved product, I understood the importance of being flexible when requirements change and to not be personally “tied” to my designs.

I worked with the developers to bring the designs to life using a dual track agile process. I participated in sprint ceremonies, QA’d their work to ensure the released product matched the approved designs, and I made myself available any time a developer had a question or problem.

In the event there was a technical blocker or change in feature requirements, I was able to quickly pivot and adjust the designs.

A new feature of Credit Insights is the addition of individual credit score and ratings pages. This provides several improvements over the Credit Builder product:

- An easy to understand description of what the score means and why it’s important

- The gauge provides context for what is a good or bad score

- The factors that impact the score or rating

- Historical trend of the score or rating as well as industry comparison

- Help for how to improve the score or rating

Below is the design for a new score page.

5. User Research

User Research was two fold:

- Discovery

- A heuristic analysis of the existing Credit Builder product.

- Review customer service tickets and prior feedback on Credit Builder.

- Product Validation of MVP

- While I would normally carry out user interviews as part of discovery, it did not occur until a few months before release.

- I created the research plan and guide.

- The questions were a combination of open ended questions, lichert scale questions, and a number of tasks.

- I recruited people to interview and designed the interactive prototype.

While my Product Manager, UX Manager, and I were hopeful that users would like the new product, the question was whether there was enough value in the product that people would want to pay for it.

User feedback was overwhelmingly positive but, affordablility was still an issue. 40% of SMB owners I interviewed didn’t have the extra money to pay for the product. Perhaps if the prototype had included all the planned features, they would have found a way to pay.

There were a few instances where participants didn’t understand the score descriptions or felt like there wasn’t enough guidance for how to improve their scores.

Finally, I synthesized the findings and presented them to the product team and senior D&B SMB management.

We took participants feedback and created user stories to be prioritized in the backlog which included rewriting the copy for some of the scores and providing more information on how to improve a score.

6. Measure and Continue to Improve

I established both a customer satisfaction survey using Net Promoter Score and a UX Tracking survey to measure usability and user experience. I synthesize the feedback and present it to the product team on a quarterly basis. I work with the team to source the root cause of any negative feedback, iterate on the designs, and ensure they are prioritized in the product backlog.

This iterative process enables D&B Credit Insights to evolve based on the changing needs of its customers.